I have had the pleasure of building Avenue Health, our full-service virtual care company, out of Wanderly, a next-generation healthcare staffing marketplace. It has been rewarding to see innovation across both the healthcare “front office” and the “back office.”

The direct result of this is: that I know a little more than I ever wanted about the healthcare workforce supply chain—specifically, the market for contingent registered nurses (RNs). I even went so far as to announce at the beginning of my time working with the Wanderly team that I “want nothing to do with this staffing stuff.”

Little did I know that Covid-19 would transform the market for contingent nurse and allied health professional labor. This small, niche market that is healthcare staffing turned into one of the most critical components of the ongoing Covid-19 response. As a self-proclaimed, “front office” healthcare person, I quickly learned that staffing models and the supply chain have a significant impact on the ability to deliver quality care to patients.

Healthcare workforce issues are among, without a doubt, the most critical issues of our time. So, with that in mind, I am going to provide an overview of the current situation, the future situation, and innovations/policies to consider in this space. This is a newsletter, so it will by no means be a comprehensive analysis of the situation, but I think it gets pretty close.

Pre-Covid Healthcare Workforce Overview

Nurses are among the professionals at the core of the healthcare workforce. I will specifically reference nursing (RN) labor supply in this newsletter, but, except where deviations are noted, most trends are relevant to allied health professionals (e.g., x-ray techs), as well.

In pre-Covid-19 times, hospitals filled their units with as many permanent, full-time nurses as needed (i.e., they still seek to do this because it’s the least expensive form of RN labor). But, hospitals struggle to fill their RN labor needs with full-time nurses from their local geographies.

Pre-Covid-19, it is important to note that there are two dynamics present in the nursing labor market:

There is an existing shortage of nurses in the country based on projected demand over the next 10 years. These estimates are usually made at the national level and look something like “we will be 257,000 to 1M RNs short of demand by 2030.”

Nurse labor is not evenly distributed geographically or temporally during times of increased demand in certain regions (e.g., Florida in the winter with snowbirds).

For a long time, hospitals, as the largest employer in their communities have exerted monopolistic pricing over permanent, local nurses, thus artificially deflating wages due to a lack of employer competition. This is also an important concept to note. Further consolidation among health systems and hospitals over the past 20 years has increased the monopolistic pricing power that exists in the labor market, thus potentially creating a barrier to entry into the profession for more nurses (i.e., lower wages, less profession entry; higher wages, more profession entry). In an efficient labor market, a limited supply of labor leads to wage increases that encourage more young people to enter a profession. Rising higher education costs may also affect the nurse labor supply.

These trends created the market for contingent/temporary nurse labor. Now, in the time of Covid-19, increased demand for health services due to a raging respiratory virus further exasperates these underlying market forces. At the end of the day, the issues with the healthcare workforce often come back to simple supply and demand economics. There are not enough clinicians in the places where demand for health services exists—and it is getting much worse.

Nurse Workforce Issues in New York, March 2020

To illustrate this point, let’s take a trip back to NYC during the beginning of the pandemic in the US, in March 2020. There are a number of hospitals in NYC, but let’s imagine that Northwell and New York-Presbyterian are our two health systems. In February 2020, both facilities likely maximized their ability to hire full-time nurses in their local NYC area and it is also likely they already had 100 - 500 contingent nurses working at that time. These contingent nurses, or travel nurses, typically work by either picking up extra shifts at a number of facilities locally for a higher rate than full-time or are brought in via a staffing agency from out of state at significantly higher wages and costs to the hospital than a full-time nurse. If you need to attract more nurses, you need to pay higher rates than other places looking to attract the same limited supply of nurses.

When Covid-19 started ripping through NYC, a densely populated area wherein respiratory viruses spread like wildfire, it led to an increased demand for ICU nurses and respiratory therapists to care for the patients. Thus, travel ICU nurse wages increased 1000%+ to attract workers from the rest of the nation to NYC. This type of localized demand is manageable, as NYC was able to tap into the national travel nurse market to attract workers at high wages. But, as we all know, the initial hot spots became the entire country and we saw wages skyrocket as facilities compete for labor.

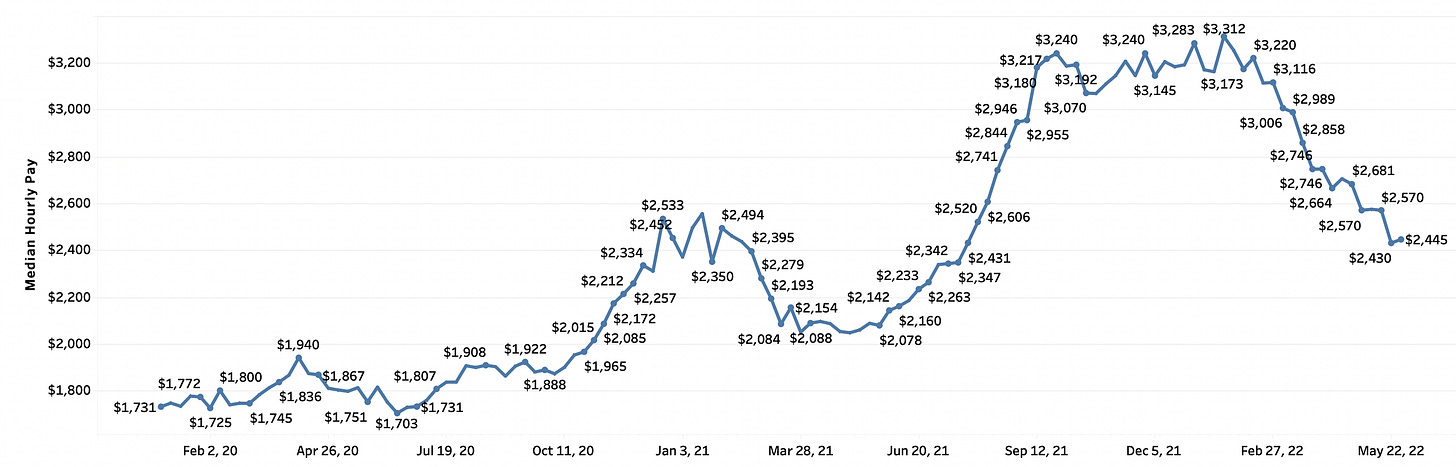

Figure 1: Weekly National Travel Nurse Wages Jan 2020 to June 2022

(Source: Wanderly Marketplace Data)

As you can see the median rates for a travel RN fluctuate very tightly with the Covid-19 incidence rate and show similar exponential growth rate trends at times. Thus, the demand for hospital services results in a subsequent demand for labor to deliver the hospital services.

Healthcare Workforce Exponential Wage Inflation Drivers During Covid-19

The trends shown in Figure 1 above are quite startling, but they are very much explainable and preventable in the future. Why did this happen? There are two reasons: 1. Supply Constraints and 2. Demand Drivers.

Let’s start with demand:

Demand Drivers during Covid-19

Diseases and Conditions in the Population: Pre-Covid, there is a certain level of demand for health services driven by the prevalence and incidence of disease in the US population. In a given area, there will be a certain number of patients requiring services such as CABG procedures, hospitalizations for diabetic ketoacidosis, and strokes.

Covid-19: Covid-19 came along, spread rapidly, and sometimes causes severe disease requiring health services support in a percentage of patients. Lots of patients in the hospital with Covid + existing hospital patients for other conditions = demand for more nurses.

Aging Population: As the US population ages as Baby Boomers retire, and develop chronic conditions, more health services become in demand. Similarly, as the population ages, more clinicians are needed to care for patients in nursing homes and in-home health settings, thus stretching the supply of RNs.

Expansion of Medical Capabilities: As we develop new technologies, drugs, procedures, and medical devices to treat heretofore untreatable conditions, we also increase the demand for health services. More things to do = more clinicians needed to do them.

Delayed Care: Covid-19 care delays for primary care visits, screenings, and other procedures likely create a sicker population that drives post-Covid-19 demand for procedures that were skipped. Thus, this effect creates a sicker population and a “rescheduling effect” that drives demand.

Worsening Mental Health: This technically falls under #1, but I think this deserves its own section. Growing rates of loneliness, depression and anxiety lead to chronic conditions and create difficulty for patients in caring for themselves at home. Thus, this trend has long-term consequences for the demand for health services.

Supply Constraints during Covid-19

The following supply constraints affect the exponential increase in nursing labor costs for hospitals:

Existing Nurse Shortage: There is an existing shortage of nurses in the country both nationally and in local geographies such as rural areas.

Covid-19 Sickness: When nurses get sick, they cannot come to work. Thus, the available workforce for a hospital during Covid-19 is impacted by Covid-19 as 10% of nurses may be unavailable at any given time due to quarantine.

Burnout, Stress, and Working Conditions: Many nurses report burnout, stress, and poor working conditions at work, thus many choose to leave the profession, bedside nursing, or have been, very reasonably, sitting out during the pandemic.

Pre-Existing Conditions: Many nurses may have pre-existing conditions that place them at high-risk for complications from Covid-19 infection, thus a non-zero percentage of beside nurses may have elected to work in different areas than the hospital. Less full-time nurses = more demand for contingent nurses.

Child Care Issues: With schools operating virtually, many nurses were forced to leave full-time work to provide child care for children. Nurses reducing shift availability due to child care = more demand for contingent nurses.

Virtual Work Opportunities: During the pandemic, telemedicine and telehealth grew exponentially and provided opportunities for nurses to work from home. These jobs are very attractive to nurses, thus it pulled supply away from the acute care facilities. Who doesn’t like working from home these days?

Opportunities to Bolster the Healthcare Workforce

There have been a number of policies discussed by legislators and government officials related to nursing labor costs. Most fall into the following categories:

State Travel Nurse Rate Caps

Staffing Ratio Waivers

Government Funding of Travel Nurses

These three “solutions” are NOT GOOD solutions. Rate caps will theoretically impact the long-term supply of nurse labor by reducing new students entering the profession due to lower wages. When enacted at the state level, it will also reduce the immediate supply of travel nurses to that state as the workforce is a national pool (i.e., if NY caps rates, the nurses will go to Pennsylvania where they did not cap rates). Staffing ratio waivers basically allow facilities to provide unsafe care to patients, thus, while during surge flexibility they may be merited, it is a BAD long-term solution to our healthcare workforce woes. Government funding of travel nurse programs is a good solution during the peaks and troughs of the pandemic as we would like the hospitals to stay financially viable and open lest we need them, but it is not a sustainable long-term solution.

The only real solution to the current healthcare workforce crisis is to increase the supply of nurses/clinicians. Unfortunately, this takes a considerable amount of time (i.e., 6-8 years).

Investments we make now will likely only yield results in 2028 at the earliest. Thus, time is of the essence. How do we do this?

Federal and state investments into nursing schools to increase capacity

Federal and state investments into nurse educator programs to build the next generation of nursing educators (i.e., this is a big barrier right now; not enough nurse teachers)

Investing in hospitals to host nursing students for clinical experience (i.e., this is also a big barrier right now; not enough clinical spots)

Reduce the cost of nursing education by subsidizing programs for students and reducing existing student loan debt

Funding profession awareness campaigns as nurses are consistently the nation’s most trusted profession

Enacting safe staffing ratio legislation to ensure nurses are able to provide safe and effective care to patients at all facilities

Enacting federal and state protections for nurses related to abuse and mistreatment

Increasing the number of and ease of obtaining visas for foreign nurses to immigrate to the US—this has been done :)

Reduce the non-value additive players in the nursing supply chain by helping hospitals adopt technologies that allow them to directly-source nursing labor—this is in progress.

Improving upskill training programs for LVN/LPN, Medical assistants, and other clinical staff to train as an RN or other allied health professional

Final Conclusions on the State of the Healthcare Workforce

How does the impending, more severe, nursing shortage impact everyone? Let’s take a look:

Hospitals: Labor costs continue to remain high impacting margins and predictability of financials. Hospitals will likely raise rates for services to cover the increased cost of providing them.

Patients: Waitlists, potentially low-quality care, and higher costs of healthcare services will be the result for patients. If you need a procedure, you may have to wait longer due to staffing-related issues. Hospitals, once they raise rates, will pass along that cost to the patient via next year’s insurance premiums and any out-of-pocket components. And, if staffing ratio legislation is delayed, it may lead to unsafe care for patients.

Insurance Companies: Insurance companies will be fine as they will raise premium rates at the same pace as hospital costs and continue to take their piece of the pie.

There will likely be a number of policies discussed by politicians, legislators, regulators, and hospital leaders. But, unfortunately, most of them will be short-term in nature. The only policies that will fundamentally alter the path forward will be those that invest in the healthcare workforce and lead to significant increases in the supply and availability of nursing labor. It is harder to do this, but it will pay off in the long term.

Thanks so much for reading. I appreciate your interest in Health Tech Happy Hour. I hope you take something away from the content each week. If you have any suggestions, questions, or topic recommendations, please send me a note on LinkedIn: https://www.linkedin.com/in/robert-l-longyear-iii-a8b284b9/ or leave a comment.